Salt Tax Deduction Limit 2025 Deduction Limit. Allow the cap to expire,. Lawmakers face a critical decision:

Back in 2017, when trump and congress reformed the tax code via the tax cuts and jobs act, they opted to cap the salt deduction at $10,000, which meant many blue state. The limit for those married filing separately is $5,000.

SALT Deduction Cap Testimony Impact of Limiting the SALT Deduction, The urgency is heightened because the salt deduction limit is set to expire at the end of 2025, if congress doesn't act.

Salt Tax Deduction Limit 2025 Notification Arly Marcia, The state and local tax deduction limitation (salt cap) has become a focal point of tax policy debate ahead of its scheduled sunset at the end of 2025.

SALT Tax Deduction What Business Owners Should Know Monument Wealth, The movement to roll back limits on how much state and local taxes americans can deduct on their federal returns took a hit wednesday when a vote to advance a salt.

Salt Tax Deduction Limit 2025 Limit Perri Brandise, Experts suggest raising this cap to ₹3.5 lakh to help taxpayers manage rising living costs and encourage more.

salt tax deduction calculator Delphia Snodgrass, The 2017 tax cuts and jobs act (tcja) imposed a $10,000 “cap” on state and local tax (salt) deductions on individual federal income tax returns for tax years 2018 through 2025.

Salt Tax Deduction Limit 2025 Limit Perri Brandise, Below, we provide a brief history of salt from.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

salt tax deduction calculator Too Big Webzine Photography, Both the salt limitations and the doubled standard deduction expire after 2025, putting salt on the 2025 menu for lawmakers.

2025 Tax Brackets And Standard Deduction Calculator Anny Malina, Lawmakers face a critical decision:

Salt Deduction Limit 2025 Calculator Bell Marika, The limit for those married filing separately is $5,000.

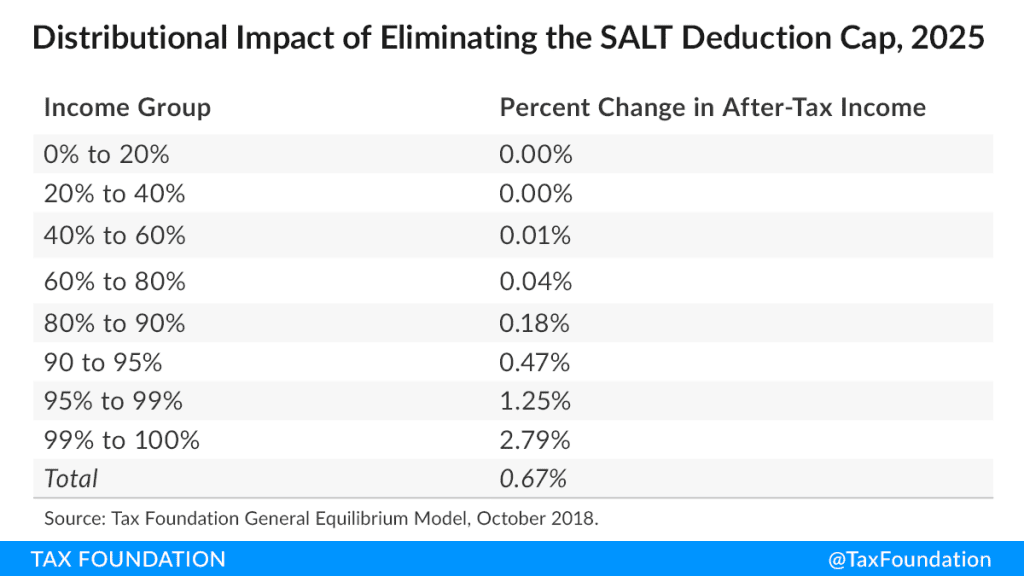

72,500 SALT Cap is Costly and Regressive20211103, The salt deduction allows taxpayers to deduct state and local taxes paid from their federally taxable income, however the 2017 tax cuts and jobs act (tcja) capped the deduction at.